Arya Sciences Acquisition Corp. is a blank check company. It formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. Arya Sciences Acquisition Corp. is based in New York, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2018-09-19 12:38:00 Wednesday ET

The Trump administration imposes 10% tariffs on $200 billion Chinese imports and expects to raise these tariffs to 25% additional duties toward the end of t

2019-04-23 19:45:00 Tuesday ET

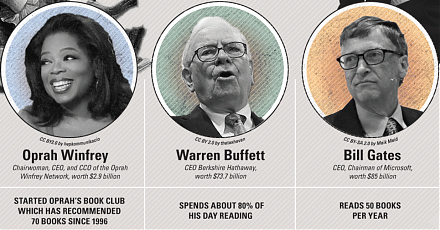

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs

2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.