Arch Resources Inc. is one of the largest coal producers in the U.S., operating nine mines across the major coal basins of the country. The locations of its mines and access to export facilities enable the company to ship coal world wide. It sold Viper operation, which had been part of the Other Thermal segment. Prior to the divestment of Viper operation, the company had 3 reportable segments: Metallurgical (MET), Powder River Basin (PRB) and Other Thermal. Its present reportable business segments are based on two distinct lines of business, metallurgical coal and thermal coal, and may include a number of mine complexes. The company has two segments: metallurgical and thermal. No changes were made to the MET Segment and the three remaining thermal mines post divestment have been combined as its Thermal Segment....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-12-29 09:32:00 Saturday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube December 2018 AYA Analytica is our online regular podcast and news

2018-12-21 11:39:00 Friday ET

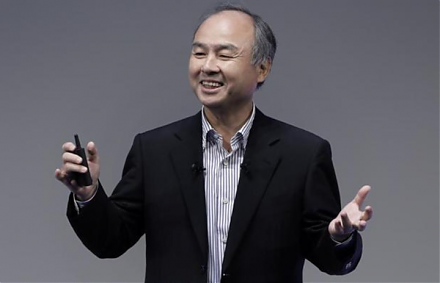

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2023-02-14 09:31:00 Tuesday ET

Eric Posner and Glen Weyl propose radical reforms to resolve key market design problems for better democracy and globalization. Eric Posner and Glen Weyl

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2020-04-17 07:23:00 Friday ET

Clayton Christensen defines and delves into the core dilemma of corporate innovation with sustainable and disruptive advances. Clayton Christensen (2000)

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund