Antero Resources Corporation is an independent explorer, primarily engaged in the acquisition and development of natural gas, natural gas liquids and oil resources in the Appalachian Basin. It is one of the fast-growing natural gas producers in the United States. The company focuses on unconventional reservoirs. It holds oil and gas properties in Appalachian Basin of in West Virginia and Ohio....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-08-27 09:35:00 Monday ET

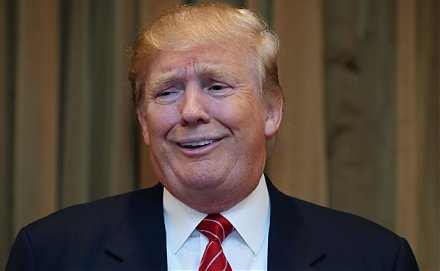

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2018-05-09 08:31:00 Wednesday ET

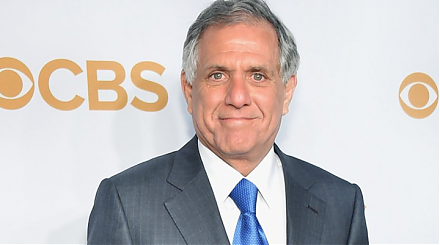

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-09-07 17:37:00 Saturday ET

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rat

2023-08-21 12:25:00 Monday ET

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions. Steven Shavell (2004)

2018-05-17 07:41:00 Thursday ET

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governa

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr