N/A...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-10-07 13:39:00 Sunday ET

The U.S. greenback soars in value as the Federal Reserve continues its interest rate hike. With impressive service-sector data and non-farm payroll wage gro

2019-08-31 14:39:00 Saturday ET

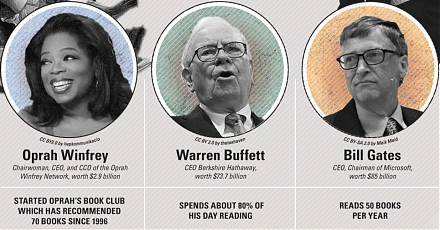

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2019-07-30 15:33:00 Tuesday ET

All of the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareho

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)

2018-01-13 08:39:00 Saturday ET

The Economist digs deep into the political economy of U.S. government shutdown over 3 days in January 2018. In more than 4 years since 2014, U.S. government

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th