Aemetis, Inc. is an advanced fuels and renewable chemicals company. It produces renewable chemicals and fuels using patented microbes and processes. Aemetis owns and operates an ethanol animal feed plant in California to produce D5 Advanced Biofuels using the sorghum/biogas/CHP pathway. The Company also built, owns, and operates a renewable chemicals and advanced fuels production facility on the East Coast of India producing high quality, distilled biodiesel and refined glycerin for customers in Europe and Asia. Aemetis, Inc. is headquartered in Cupertino, California....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-03-05 08:28:00 Thursday ET

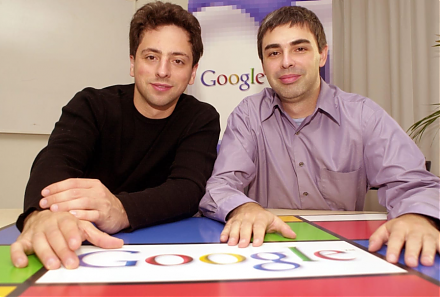

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2018-07-21 13:35:00 Saturday ET

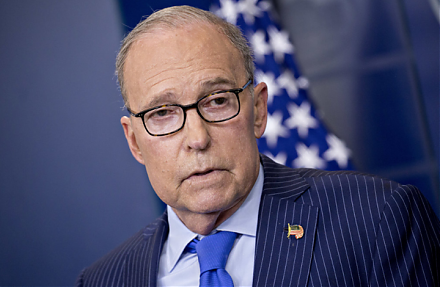

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2017-12-11 08:42:00 Monday ET

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to t

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to