Amyris INC is an integrated renewable products company applying industrial synthetic biology to genetically modify microorganisms to serve as living factories. Amyris designs these microorganisms to produce defined molecules for use as renewable chemicals and transportation fuels. The Company is engaged in the development of farmesene- a molecule, which serves as the base chemical building block for a wide range of renewable products to replace existing products that are derived from petroleum, plant or animal sources and that may be of lower quality or higher price. Amyris INC is headquartered in Emeryville, CA....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2018-05-01 11:38:00 Tuesday ET

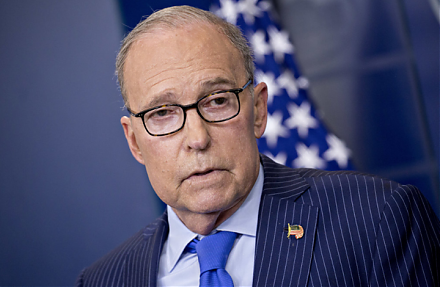

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2020-08-19 10:32:00 Wednesday ET

Corporate strategies, portfolio choices, and management memes add value and drive business process improvements over time. Andrew Campbell, Jo Whitehead,

2022-11-05 11:32:00 Saturday ET

CEO overconfidence and corporate performance Malmendier and Tate (JFE 2008, JF 2005) argue that overconfident CEOs are more likely to initiate mergers an

2019-03-11 10:32:00 Monday ET

Lyft seeks to go public with a dual-class stock ownership structure that allows the co-founders to retain significant influence over the rideshare tech unic

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an