AstroNova, Inc. provides data visualization technologies. The company designs, manufactures, distributes and services products which acquire, store, analyze and present data in multiple formats. The Product Identification segment offers hardware and software products and associated consumables. Test and Measurement segment includes suite of products and services which acquire and record electronic signal data from local and networked sensors. Its brand includes QuickLabel(R). AstroNova, Inc., formerly known as Astro-Med, Inc., is based in WEST WARWICK, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-06-13 10:26:00 Thursday ET

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent

2017-12-01 06:30:00 Friday ET

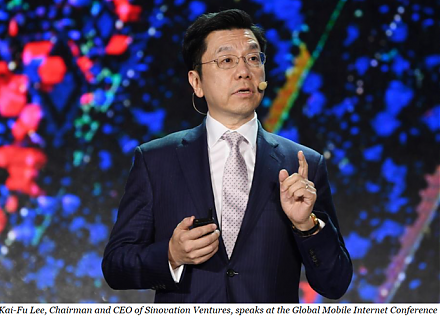

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2019-01-03 10:38:00 Thursday ET

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spen

2019-06-30 12:37:00 Sunday ET

AYA Analytica finbuzz podcast channel on YouTube June 2019 In this podcast, we discuss several topical issues as of June 2019: (1) Federal Reserve h

2018-08-25 12:33:00 Saturday ET

President Trump warns Google, Facebook, and Twitter that these tech titans now tread on troublesome territory. Specifically, Trump accuses Google of rigging

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g