Allegro Merger Corp. does not have significant operations. The company intends to acquire a business through merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization, or other similar business combination. Allegro Merger Corp. was founded in 2017 and is based in New York, New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-15 08:40:00 Tuesday ET

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2017-12-19 09:39:00 Tuesday ET

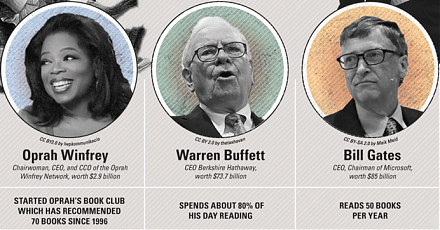

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2023-11-14 08:24:00 Tuesday ET

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2016-11-09 00:00:00 Wednesday ET

Universally dismissed as a vanity presidential candidate when he entered a field crowded with Republican talent, the former Democrat and former Independent