Allegro Merger Corp. does not have significant operations. The company intends to acquire a business through merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization, or other similar business combination. Allegro Merger Corp. was founded in 2017 and is based in New York, New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-03-27 06:33:00 Monday ET

Goldman Sachs chief economist Jan Hatzius says the Federal Reserve's QE exit strategy makes sense ahead of Fed Chair Janet Yellen's stepdown in 2018

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2019-08-31 14:39:00 Saturday ET

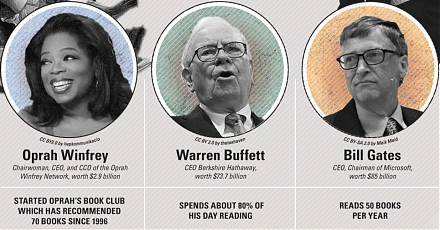

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2019-08-28 14:46:00 Wednesday ET

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr