BLDRS Developed Markets 100 ADR Index Fund (the Fund) is a unit investment trust designed to provide investment results that correspond generally to the price and yield performance of the publicly traded depositary receipts comprising The Bank of New York Developed Markets 100 ADR Index. As of September 30, 2006, The BNY Developed Markets 100 ADR Index included 100 component depositary receipts representing the securities issued by 100 of the most actively traded companies from the international developed markets having a free-float market capitalization ranging from $10 billion to over $260 billion. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-11-21 11:34:00 Thursday ET

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. ec

2017-08-01 09:40:00 Tuesday ET

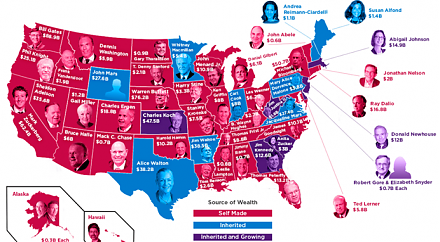

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs

2018-02-15 07:43:00 Thursday ET

Fed minutes reflect gradual interest rate normalization in response to high inflation risk. FOMC members revise up the economic projections made at the Dece

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c