Accel Entertainment Inc. is a distributed gaming operator primarily in the United States. The company's business consists of the installation, maintenance and operation of VGTs, redemption devices which disburse winnings and contain ATM functionality, other amusement devices in authorized non-casino locations such as restaurants, bars, taverns, convenience stores, liquor stores, truck stops and grocery stores. Accel Entertainment Inc., formerly known as TPG Pace Holdings Corp., is based in Fort Worth, Texas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-09-01 07:34:00 Saturday ET

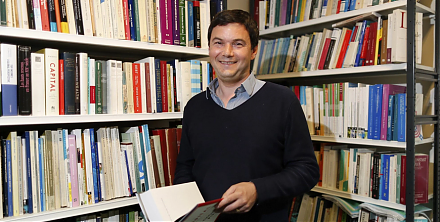

As the French economist who studies global economic inequality in his recent book *Capital in the New Century*, Thomas Piketty co-authors with John Bates Cl

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2022-10-05 08:24:00 Wednesday ET

Precautionary-motive and agency reasons for corporate cash management Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled t

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers