Altaba Inc. (the Fund), formerly Yahoo! Inc., is a non-diversified, closed-end management investment company. The Fund seeks to track the combined investment return of the Alibaba Shares and the Yahoo Japan Shares it owns. Alibaba Shares represent an approximate 15% equity interest in Alibaba Group Holding Limited (Alibaba), and its Yahoo Japan Corporation ((Yahoo Japa) Shares represent an approximate 36% equity interest in Yahoo Japan. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2018-08-11 14:35:00 Saturday ET

The Trump administration imposes 20%-50% tariffs on Turkish imports due to a recent spat over the detention of an American pastor, Andrew Brunson, in Turkey

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2019-09-23 12:25:00 Monday ET

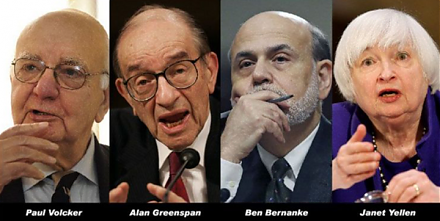

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo