2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2018-11-19 09:38:00 Monday ET

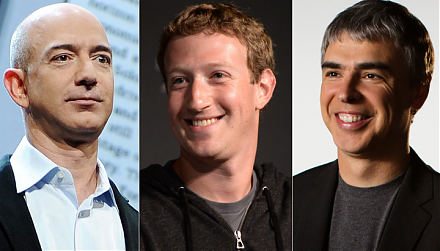

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-06-21 13:33:00 Friday ET

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement

2018-02-19 08:39:00 Monday ET

Snap cannot keep up with the Kardashians because its stock loses market value 7% or $1 billion after Kylie Jenner tweets about her decision to leave Snapcha

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2020-11-03 08:30:00 Tuesday ET

Agile lean enterprises break down organizational silos to promote smart collaboration for better profitability and customer loyalty. Heidi Gardner (2017