2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.

2018-12-09 08:44:00 Sunday ET

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum

2020-05-14 12:35:00 Thursday ET

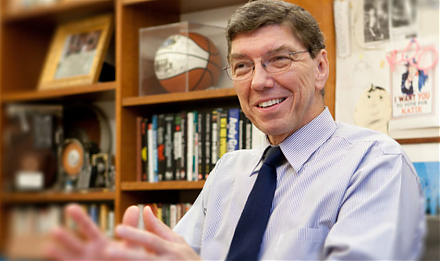

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2019-04-26 09:33:00 Friday ET

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnat

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla