2023-04-21 12:39:00 Friday ET

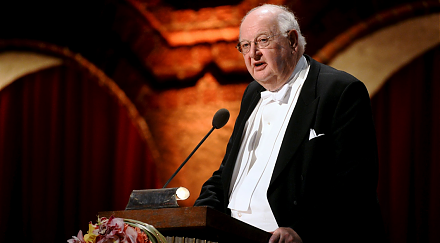

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)

2025-10-01 10:29:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-09-21 09:26:00 Thursday ET

Jordi Gali delves into the science of the New Keynesian monetary policy framework with economic output and inflation stabilization. Jordi Gali (2015)

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2018-04-13 14:42:00 Friday ET

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dicta

2019-04-30 19:46:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube April 2019 In this podcast, we discuss several topical issues as of April 2019: (1) Our proprietary