| Symbol | BSFC |

| Exchange | NASDAQ |

| Major index membership | - |

| Current market capitalization | 3.01M |

| Trailing 12-month net income | -4.00M |

| Trailing 12-month sales revenue | 6.61M |

| Current book value per share (BPS) | 2.03 |

| Current cash value per share (CPS) | 0.03 |

| Annual dividend payout | - |

| Annual dividend accrual | - |

| Dividend ex-date | - |

| Number of full-time employees | 39 |

| Stock with tradable options and short sales | No / Yes |

| Last quarter sales surprise | - |

| Distance from 20-day simple moving average (SMA20) | -24.03% |

| Trailing 12-month price-to-earnings ratio (P/E ratio) | - |

| Forward 12-month price-to-earnings ratio (P/E ratio) | - |

| Price-to-earnings growth (PEG) | - |

| Trailing 12-month price-to-sales ratio (P/S ratio) | 0.46 |

| Current price-to-book ratio (P/B ratio) | 0.59 |

| Current price-to-cash ratio (P/C ratio) | 43.03 |

| Trailing 12-month price-to-free-cash-flow ratio (P/FCF ratio) | - |

| Most recent quick ratio | 0.97 |

| Most recent current ratio | 1.78 |

| Most recent debt-to-equity leverage (D/E ratio) | 0.28 |

| Most recent long-term-debt-to-equity leverage (LTD/E ratio) | 0.06 |

| Last quarter earnings-per-share (EPS) surprise | - |

| Distance from 50-day simple moving average (SMA50) | -38.02% |

| Trailing 12-month earnings-per-share (EPS) | -11.43 |

| Forward annual earnings-per-share (EPS) | - |

| Forward quarterly earnings-per-share (EPS) | - |

| Current earnings-per-share growth (EPSG) | - |

| Forward earnings-per-share growth (EPSG) | - |

| Long-term current earnings-per-share growth (EPSG) | - |

| Long-term past earnings-per-share growth (EPSG) | - |

| Long-term past sales revenue growth (SRG) | -18.82% |

| Short-term earnings-per-share growth (EPSG) | 97.70% |

| Short-term sales revenue growth (SRG) | -17.80% |

| Last quarter earnings-per-share growth (EPSG) | 95.04% |

| Last quarter sales revenue growth (SRG) | 7.31% |

| Distance from 200-day simple moving average (SMA200) | -74.11% |

| Insider stock ownership concentration | 7.17% |

| Most recent change in insider ownership | 34.34% |

| Institutional stock ownership concentration | 0.32% |

| Most recent change in institutional ownership | 38.18% |

| Trailing 12-month return on assets (ROA) | -52.93% |

| Trailing 12-month return on equity (ROE) | -174.10% |

| Trailing 12-month return on investment (ROI) | -82.17% |

| Trailing 12-month gross profit margin (GPM) | -13.71% |

| Trailing 12-month operating profit margin (OPM) | -57.05% |

| Trailing 12-month net profit margin (NPM) | -60.59% |

| Trailing 12-month dividend payout ratio | - |

| Earnings date before/after market open/close (BMO/AMC) | May 20 BMO |

| Additional trade activity | N/A |

| Number of outstanding shares | 2.51M |

| Number of floating shares | 2.33M |

| Number of short-interest shares | 2.59% |

| Short interest ratio | 0.04 |

| Short interest dollar amount | 0.06M |

| Trailing 52-week stock price range | 0.98 - 46.00 |

| Distance from 52-week high | -97.39% |

| Distance from 52-week low | 22.01% |

| Relative strength index (RSI) | 36.54 |

| Stock analysts' average recommendation (1=buy to 5=sell) | 1.00 |

| Current relative trading volume | 2.93 |

| Current average trading volume | 1.67M |

| Current stock trading volume | 4,746,783 |

| Most recent weekly stock price performance | 8.11% |

| Most recent monthly stock price performance | -39.70% |

| Most recent quarterly stock price performance | -63.08% |

| Most recent semi-annual stock price performance | -79.68% |

| Most recent annual stock price performance | -97.27% |

| Most recent year-to-date stock price performance | -83.33% |

| Most recent stock market beta | 2.45 |

| Current average true range | 0.24 |

| Most recent weekly and monthly return volatility | 19.83% 13.55% |

| Stock analysts' average target price | 1000.00 |

| Previous stock price close-of-business | 1.11 |

| Current stock price | 1.20 |

| Most recent daily stock price performance | 8.11% |

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2017-04-19 17:37:00 Wednesday ET

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the

2017-12-19 09:39:00 Tuesday ET

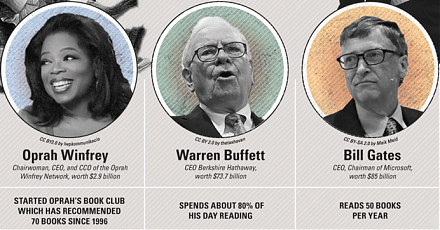

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an