2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2018-07-03 11:42:00 Tuesday ET

President Trump's current trade policies appear like the Reagan administration's protectionist trade policies back in the 1980s. In comparison to th

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th

2023-05-14 12:31:00 Sunday ET

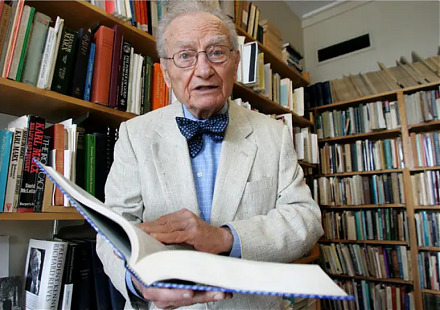

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m