2018-10-23 12:36:00 Tuesday ET

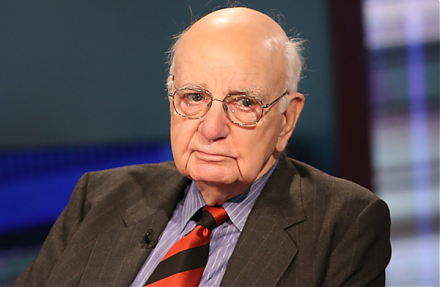

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2025-09-24 09:49:53 Wednesday ET

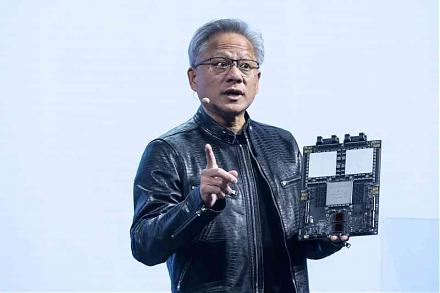

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-06-21 05:36:00 Wednesday ET

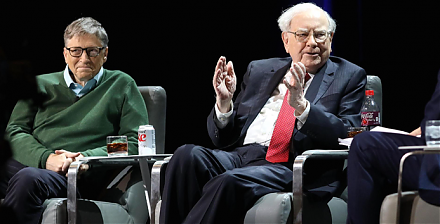

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2018-11-09 11:35:00 Friday ET

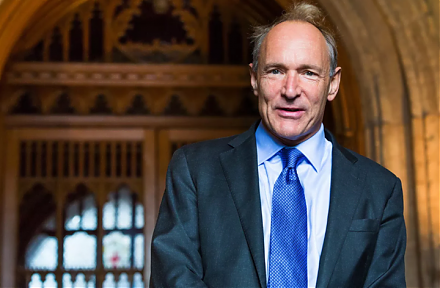

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-10-21 14:40:00 Sunday ET

President Trump floats generous 10% tax cuts for the U.S. middle class ahead of the November 2018 mid-term elections. Republican senators, congressmen, and

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d