2017-03-27 06:33:00 Monday ET

Goldman Sachs chief economist Jan Hatzius says the Federal Reserve's QE exit strategy makes sense ahead of Fed Chair Janet Yellen's stepdown in 2018

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2019-01-19 12:38:00 Saturday ET

U.S. government shuts down again because House Democrats refuse to spend $5 billion on the border wall that would give President Trump great victory on his

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

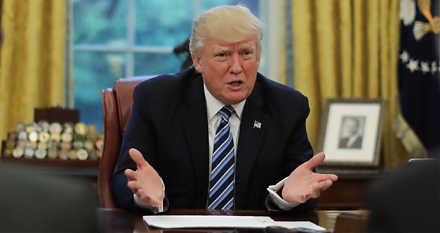

2017-07-01 08:40:00 Saturday ET

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo