2019-12-22 08:30:00 Sunday ET

European Commission President Ursula von der Leyen now protects the European circular economy and green growth from 2020 to 2050. The new circular economy r

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model

2023-04-21 12:39:00 Friday ET

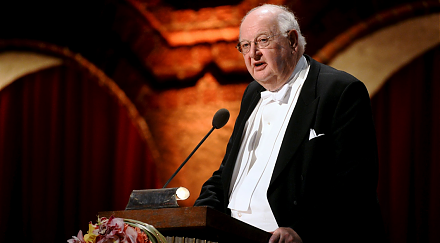

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)

2019-12-04 14:35:00 Wednesday ET

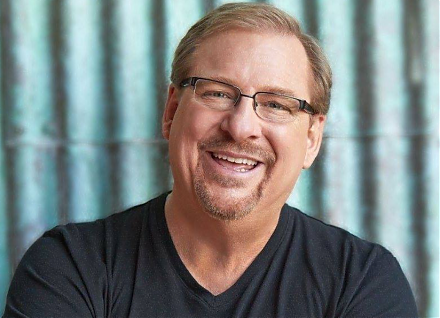

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an