Home > Library > AYA fintech network platform: major milestones, key product features, and online social network services

Author Chanel Holden

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2023, this report focuses on the major milestones, key product features, and online social media services across our AYA fintech network platform. The AYA major milestones include our proprietary alpha stock investment model configuration, U.S. fintech patent protection and accreditation for 20 years, landmark ebook publications on the Trump to Biden economic policy reforms, and new empirical research articles on macrofinance, asset return prediction, financial intermediary capital structure, and corporate ownership governance. We include a complete fintech founder profile toward the end of this report.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2023, this report focuses on the major milestones, key product features, and online social media services across our AYA fintech network platform. The AYA major milestones include our proprietary alpha stock investment model configuration, U.S. fintech patent protection and accreditation for 20 years, landmark ebook publications on the Trump to Biden economic policy reforms, and new empirical research articles on macrofinance, asset return prediction, financial intermediary capital structure, and corporate ownership governance. We include a complete fintech founder profile toward the end of this report.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor’s social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this ebook! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

2024-07-31 09:28:00 Wednesday ET

In the modern monetary system, each new CBDC helps anchor public trust in money in support of economic welfare, especially in a cashless society. In our

2020-03-05 08:28:00 Thursday ET

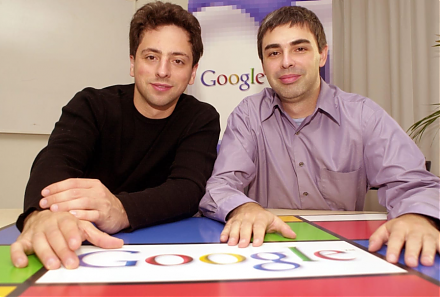

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2018-08-23 11:34:00 Thursday ET

Harvard financial economist Alberto Cavallo empirically shows the recent *Amazon effect* that online retailers such as Amazon, Alibaba, and eBay etc use fas

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an