Home > Library > AYA analytic report on the global macro economic outlook January 2024

Author Daphne Basel

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Winter-Spring 2024, this macro analytic report focuses on the new world order of trade. In light of both recent tariffs and foreign investment restrictions in the Sino-American trade war, the U.S. further decouples and derisks from China. The World Trade Organization (WTO) continues to help resolve trade disputes as the Biden administration requires fair and reciprocal bilateral trade engagements with China. Many western allies should strengthen the global supply chains for AI, 5G, semiconductors, rare earths, pharmaceutical ingredients, and electric vehicles. Global trade partners should work together to reduce carbon emissions worldwide in accordance with ESG rules and regulations.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Winter-Spring 2024, this macro analytic report focuses on the new world order of trade. In light of both recent tariffs and foreign investment restrictions in the Sino-American trade war, the U.S. further decouples and derisks from China. The World Trade Organization (WTO) continues to help resolve trade disputes as the Biden administration requires fair and reciprocal bilateral trade engagements with China. Many western allies should strengthen the global supply chains for AI, 5G, semiconductors, rare earths, pharmaceutical ingredients, and electric vehicles. Global trade partners should work together to reduce carbon emissions worldwide in accordance with ESG rules and regulations.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2017-03-15 08:46:00 Wednesday ET

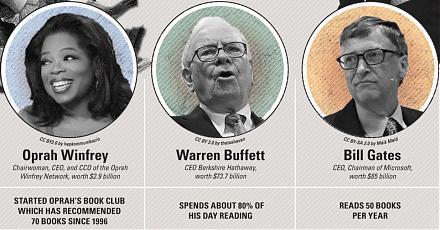

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2019-02-25 12:41:00 Monday ET

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests