Home > Library > Algorithmic credit portfolio segmentation

Author Andy Yeh Alpha

This research article proposes a new algorithmic model for credit portfolio segmentation.

Description:

Under the new Basel bank capital framework, each bank must group its retail exposures into multiple segments with homogeneous risk characteristics. The U.S. regulatory agencies believe that each bank may use its internal risk models for the loan-level risk parameter estimates such as probability of default (PD) and loss given default (LGD) to group individual exposures into the resultant segments with homogeneous risk attributes. In stark contrast to the conventional decision-tree method, we propose a new algorithmic technique for retail consumer loan portfolio segmentation. This new technique identifies the optimal number of segments, sorts the individual loan exposures into the various segments, and then leads to the minimal degree of risk heterogeneity in comparison to the baseline equal-bin and quantile-bin schemes. Furthermore, we analyze the Monte Carlo implicit asset correlation values for the retail loan segments over time to help assess the implications for bank capital measurement. The best-fit method for retail credit portfolio segmentation results in some capital relief that serves as an economic incentive for the bank to invest in this alternative segmentation. This positive outcome accords with the core principle of statistical conservatism that the financial econometrician enshrines in the Basel regulatory requirements for bank capital measurement.

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)

2017-08-01 09:40:00 Tuesday ET

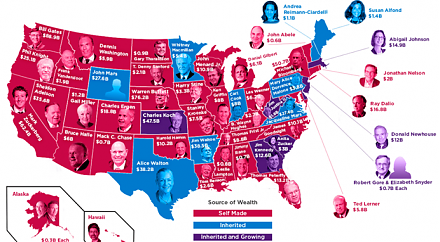

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2019-02-15 11:33:00 Friday ET

President Trump is open to extending the March 2019 deadline for raising tariffs on Chinese imports if both sides are close to mutual agreement. These bilat

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why