Home > Library > AYA analytic report on the global macro economic outlook August 2021

Author Andy Yeh Alpha

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2021, the macro analytic report delves into the recent Biden fiscal and monetary stimulus programs, global trade trends, credit flows, and the global economic revival during the recent rampant Covid-19 corona virus crisis. We focus on the economic priorities in light of the global macro-financial outlook in terms of low interest rate prevalence, fiscal and monetary stimulus, and tech titan dominance. Whether the global economy can soon recover from Covid-19, Brexit, and Sino-U.S. trade uncertainty remains an open controversy.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2021, the macro analytic report delves into the recent Biden fiscal and monetary stimulus programs, global trade trends, credit flows, and the global economic revival during the recent rampant Covid-19 corona virus crisis. We focus on the economic priorities in light of the global macro-financial outlook in terms of low interest rate prevalence, fiscal and monetary stimulus, and tech titan dominance. Whether the global economy can soon recover from Covid-19, Brexit, and Sino-U.S. trade uncertainty remains an open controversy.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2018-05-07 07:32:00 Monday ET

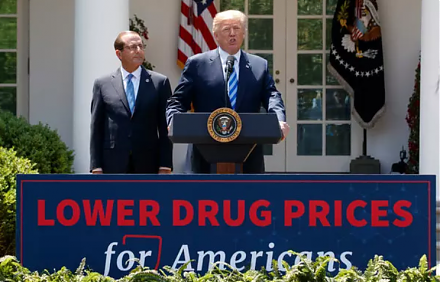

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2019-06-27 10:39:00 Thursday ET

Berkeley tax economists Gabriel Zucman and Emmanuel Saez find fresh insights into wealth inequality in America. Their latest estimates show that the top 0.1