Home > Library > AYA analytic report on the global macro economic outlook August 2021

Author Andy Yeh Alpha

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2021, the macro analytic report delves into the recent Biden fiscal and monetary stimulus programs, global trade trends, credit flows, and the global economic revival during the recent rampant Covid-19 corona virus crisis. We focus on the economic priorities in light of the global macro-financial outlook in terms of low interest rate prevalence, fiscal and monetary stimulus, and tech titan dominance. Whether the global economy can soon recover from Covid-19, Brexit, and Sino-U.S. trade uncertainty remains an open controversy.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2021, the macro analytic report delves into the recent Biden fiscal and monetary stimulus programs, global trade trends, credit flows, and the global economic revival during the recent rampant Covid-19 corona virus crisis. We focus on the economic priorities in light of the global macro-financial outlook in terms of low interest rate prevalence, fiscal and monetary stimulus, and tech titan dominance. Whether the global economy can soon recover from Covid-19, Brexit, and Sino-U.S. trade uncertainty remains an open controversy.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-10-01 11:33:00 Tuesday ET

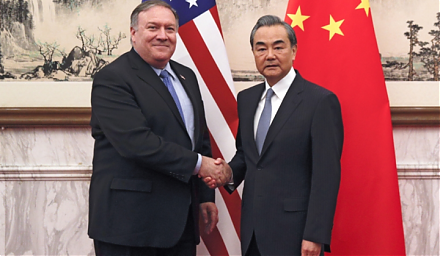

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2025-10-01 10:29:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi

2023-08-14 09:25:00 Monday ET

Peter Isard analyzes the proper economic policy reforms and root causes of global financial crises of the 1990s and 2008-2009. Peter Isard (2005) &nbs

2024-10-31 09:26:00 Thursday ET

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to enhance human lives with better productivity.

2018-01-09 08:33:00 Tuesday ET

BlackRock CEO Larry Fink emphasizes his key conviction that public corporations should make a positive contribution to society apart from boosting the botto