Home > Library > AYA analytic report on the top tech titans (FAMGA) May 2021

Author Chanel Holden

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.). As of Spring-Summer 2021, this report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan. The recent rampant corona virus crisis worsens economic inequality due to AI, 5G, and VR.

Description:

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.). As of Spring-Summer 2021, this tech report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan. The recent rampant corona virus crisis worsens economic inequality due to artificial intelligence, 5G high-speed data transmission, and virtual reality.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2023-10-21 11:32:00 Saturday ET

Walter Scheidel indicates that persistent European fragmentation after the collapse of the Roman Empire leads to modern economic growth and development.

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

2017-04-25 06:35:00 Tuesday ET

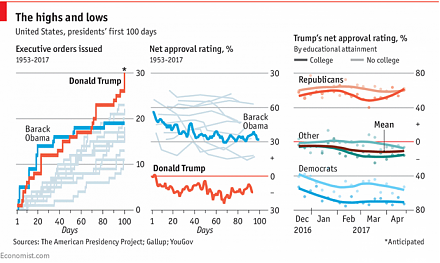

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2018-09-11 18:36:00 Tuesday ET

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $