Home > Library > Key motifs in the home-host mantra of operational risk management

Author Andy Yeh Alpha

This research article explains the topical issues in home-host operational risk management under the new Basel bank capital framework.

Description:

This paper discusses the key policy issues around the policy implementation of the Basel advanced measurement approach (AMA) to operational risk management. These issues pertain to operational risk governance, capital measurement and allocation, and future advances in operational risk transfer. Although we assess these issues from a host supervisor's perspective, the main themes have practical implications in a broader home-host context.

In terms of operational risk governance in the host regime, the local board and senior management must take an active interest in operational risk management. Several work streams such as operational loss scenario analysis, business continuity management, and external audit or other forms of independent assurance could help reinforce this active interest. Also, the significant subsidiary of a globally active bank is expected to hold an adequate amount of capital for operational risk. At the more disaggregated level, capital allocation must create sound incentives for business lines to carry out effective operational risk management processes. This capital allocation calls for the integration of the operational risk management processes into the business-as-usual teams. Furthermore, it is important to create a robust nexus between managerial pay and operational risk-adjusted return. This nexus helps strengthen the incentives for business lines to enhance the overall quality of operational risk management over time.

Future work could shed fresh light on the treatment of diversification benefits between operational risk and other risks as part of the Pillar 2 supervisory review process. This work adds value to the internal capital adequacy assessment process (ICAAP). Also, future developments should help promote operational risk transfer via insurance contracts or derivatives. These risk products could help advance the evolution of operational risk management to a new era.

2017-12-11 08:42:00 Monday ET

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to t

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become

2018-06-10 19:41:00 Sunday ET

Apple enters a multi-year content partnership with Oprah Winfrey to provide new original online video and TV programs in direct competition with Netflix, Am

2017-03-03 05:39:00 Friday ET

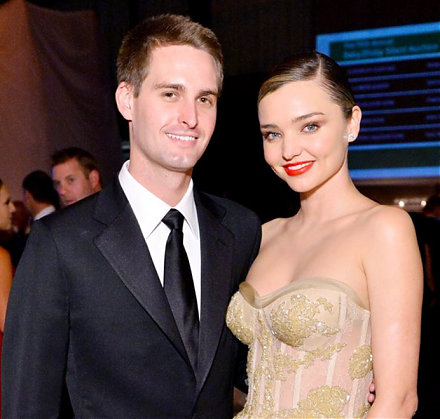

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2019-04-03 11:35:00 Wednesday ET

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity