2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2020-04-03 09:28:00 Friday ET

The Intel trinity of Robert Noyce, Gordon Moore, and Andy Grove establishes the primary semiconductor tech titan in Silicon Valley. Michael Malone (2014)

2023-07-14 10:32:00 Friday ET

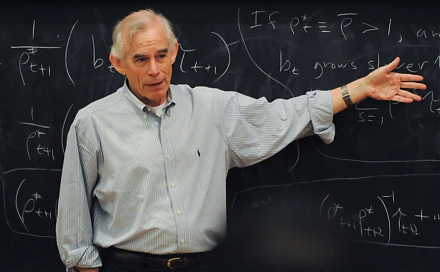

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid