2020-02-19 14:35:00 Wed ET

stock market federal reserve monetary policy treasury interest rate macrofinance investments mergers acquisitions recession stock return s&p 500 fiscal stimulus principles financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis.

Simon Johnson and James Kwak (2010)

13 bankers: the Wall Street takeover and the next financial meltdown

In this business book, Johnson and Kwak advocate that the U.S. bank oligarchy is too big to fail as the mega banks relentlessly continue to expand their political clout and economic influence in Wall Street and Washington. Without structural changes to the financial system, the U.S. may experience another main economic downturn that would be more severe than the Global Financial Crisis of 2008-2009.

Johnson and Kwak delve into the decades of U.S. regulatory history that precedes the Global Financial Crisis of 2008-2009. The U.S. has a long history of mistrusting large banks. Opponents of big banks include Thomas Jefferson, Andrew Jackson, Theodore Roosevelt, and Franklin Roosevelt.

In the 1970s and 1980s, the U.S. went through significant financial deregulations. Banks were able to transform their fresh economic power into political clout in the 1990s. As of early-2010, the top 6 mega banks were U.S. national champions that might be viewed as too big to fail in terms of sheer size: Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo.

Johnson and Kwak propose a radical policy remedy to prevent the Global Financial Crisis. Breaking up big banks requires Congress to specify limits on bank size, and regulators should strictly enforce these size limits. Johnson and Kwak recommend size limits of about 4% of U.S. GDP for all banks and at least 2% of U.S. GDP for investment banks.

An alternative policy remedy would entail significantly raising capital requirements for big banks or systemically important financial institutions in the macro-prudential stress tests. Nobel Laureate Roger Myerson and Stanford finance professor Anat Admati and their co-authors indicate that the core capital ratio for U.S. large banks should increase to double digits in the reasonable range of 13%-25%. Some recent Federal Reserve research documents empirical evidence in support of this remedy. Either the U.S. regulators break up the big banks to reduce systemic risk exposure, or these regulators should require the mega banks to boost their core capital ratios for better financial market stabilization.

In the early U.S. economic history, Treasury Secretary Alexander Hamilton felt that the federal government should play an active and vital role in supporting economic development. The Bank of the U.S. would be responsible for managing the federal government's public finance. The Bank of the U.S. would further serve as a critical source of credit for corporations, financiers, and small-to-medium firms. However, Thomas Jefferson opposed this big bank model because he feared that the Bank of the U.S. would pick economic winners and losers through its credit decisions.

Although Jefferson expressed his grave concern and opposition about the Bank of the U.S., President George Washington signed the legislation to create the bank. Hamilton carefully managed cash flows through the U.S. Treasury, kept money on deposits with banks, and provided periodic reports to Congress on credit and some other aspect of the broader U.S. economy. As bank credit grew, U.S. founders and entrepreneurs were able to invest in new businesses.

The Bank of the U.S. charter expired in 1811, and Congress passed legislation to start the Second Bank of the U.S. with a 20-year charter. President James Madison signed the law, and the bank began its core operations in 1816. President Andrew Jackson disliked the Second Bank for both economic and political reasons as the bank might cause unnecessary economic distortions with fiat money. Further, the bank monopoly over public finance might grant its directors exorbitant power and profitability. President Jackson eventually vetoed the congressional renewal of the Second Bank charter. His veto helped prevent powerful private banks from political entrenchment and interference.

In the late-1880s to 1890s, the economic trend of industrialization created a class of wealthy financiers in America. These financiers held political clout at many levels of government. President Theodore Roosevelt attempted to help improve the direct supervision of large companies. He further focused on breaking up industrial trusts via the Sherman Antitrust Act. Through these conscious efforts, he wanted to help insulate the democratic system from wealthy financiers as U.S. consumers would then enjoy greater economic benefits.

In 1913, President Woodrow Wilson and his adviser Louis Brandeis implemented the Federal Reserve Act. This legislation empowered the president to appoint the Federal Reserve Board with a lesser emphasis on central bank independence. In practice, the Federal Reserve Act built a new political institution that could rescue private banks with public funds during a financial crisis. The Federal Reserve thus served as the legitimate lender of last resort. In the grand scheme, however, this institution induced moral hazard in the sense that banks would take on more risky assets to maximize shareholder returns to the detriment of American taxpayers.

In 1929, Federal Reserve stepped into the stock market crash to help as the lender of last resort. Despite several conscious efforts, the economy slipped into the Great Depression. In hindsight, the Federal Reserve should have expanded credit supply to stabilize the U.S. financial system soon after the stock market crash. President Franklin Roosevelt sought to protect U.S. society from big banks and their political and economic clout. The Glass-Steagall Act of 1933 helped separate commercial banking activities from investment banking activities. The primary policy objective was to insulate commercial banks from the high-risk activities in which investment banks participated in the late-1920s and early-1930s. The landmark legislation was successful in promoting 50 years of financial stability. Through these decades, the Jefferson suspicion of mega bank power continued to be an essential thread in the socioeconomic fabric of American democracy. The stock market crash and Great Depression of 1929-1930 and the subsequent Global Financial Crisis of 2008-2009 made the Jefferson suspicion less out of fashion.

In the mid-1990s, financial crises erupted in several non-U.S. countries. In South Korea, Indonesia, and Russia, a small group of rich elites leveraged foreign capital to fund domestic long-term investments. As the East Asian financial crisis arose in the broader context of close relationships between government and wealthy family business groups, many central state and family enterprises were not able to repay high debt and interest amounts in due course. True financial reform would require reducing the economic power and political clout of oligarchies to bring about a key economic system that would encourage competition among the main corporations.

In the 1990s, Wall Street firms transformed their economic power into political clout. Politicians from both parties came to favor financial innovation, securitization, and deregulation. Banks made campaign contributions and payments to lobbyists. Wall Street firms sent senior employees to Washington as civil servants, and thus Wall Street insiders were able to shape government policy and financial deregulation in this way. In recent years, more Wall Street insiders moved to Washington to work in government roles. At the same time, more former bureaucrats and technocrats accepted jobs in the private financial sector.

The widespread acceptance of Wall Street engagements in Washington occurred during the Clinton administration when Robert Rubin served as Treasury Secretary and Alan Greenspan was the Federal Reserve chairman. Rubin recruited Treasury bureaucrats from Wall Street and so cultivated a crop of Democratic policymakers. Greenspan opposed government intervention in the U.S. efficient financial market. This macro environment resulted in a laissez faire regulatory landscape that varied little in the transition to the next Bush administration.

The U.S. financial sector heavily promoted subprime mortgages, derivatives, and other securitization products. Subprime mortgage borrowers often met none of the creditworthiness standards and thus lacked the ability to repay mortgage debt. As the subprime mortgage loans carried higher default risk, the loan originators would require higher interest rates. As high interest rates would attract high-risk subprime mortgage borrowers, this adverse selection exacerbated the vicious circle via the big byzantine securitization of residential mortgage loans.

In August 2008, the subprime mortgage crisis erupted as a host of major mortgage defaults caused collateral damage to the U.S. financial system. Treasury Secretary Henry Paulson, his successor Timothy Geithner, and Federal Reserve Chair Ben Bernanke offered blank checks to the major 9 banks with $700 billion to buy toxic assets from financial institutions such as Bear Stearns, Fannie Mae, Freddie Mac, and AIG etc. In theory, the government guarantee meant that U.S. Treasury owned part of the banks. However, Treasury agreed not to influence the management and corporate governance of these banks with no board nominations nor appointments in practice. In this fashion, the government could hardly change bank behavior and moral hazard in the future.

Johnson and Kwak propose a radical policy remedy to prevent the Global Financial Crisis. Breaking up big banks requires Congress to specify limits on bank size, and regulators should strictly enforce these size limits. Johnson and Kwak recommend size limits of about 4% of U.S. GDP for all banks and at least 2% of U.S. GDP for investment banks. Breaking up big banks would level the playing field for the U.S. financial system. These size limits would weaken the economic power and political clout of mega banks. Instead of competing for implicit government guarantees and subsidies, banks would have to compete on the primary basis of financial products, prices, and services etc.

An alternative policy remedy would entail significantly raising capital requirements for big banks or systemically important financial institutions in the macro-prudential stress tests. Nobel Laureate Roger Myerson and Stanford finance professor Anat Admati and their co-authors indicate that the core capital ratio for U.S. large banks should increase to double digits in the reasonable range of 13%-25%. Some recent Federal Reserve research documents empirical evidence in support of this remedy. Either the U.S. regulators break up the big banks to reduce systemic risk exposure, or these regulators should require the mega banks to boost their core capital ratios for better financial market stabilization.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) © 2013-2023

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-04-03 09:28:00 Friday ET

The Intel trinity of Robert Noyce, Gordon Moore, and Andy Grove establishes the primary semiconductor tech titan in Silicon Valley. Michael Malone (2014)

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

2020-03-19 13:39:00 Thursday ET

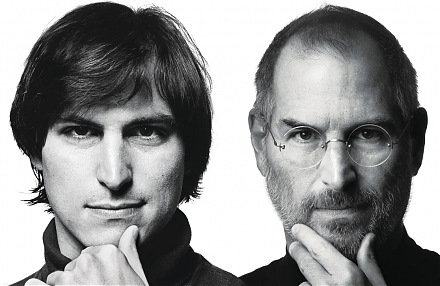

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2018-06-29 11:41:00 Friday ET

Amazon acquires an Internet pharmacy PillPack in order to better compete with Walgreens Boots Alliance, CVS Health, Rite Aid, and many other drug distributo

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal