2019-03-13 12:35:00 Wed ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete one of the largest tech IPOs with $120 billion firm valuation in April 2019. Both Uber and its rideshare rival Lyft release their recent S-1 confidential paperwork as of December 2018. With $50 billion taxi reservations and $11 billion net revenue, Uber runs a rideshare user network that is more diverse than the Lyft counterpart. As a global tech-savvy transportation company, Uber now operates in more than 70 countries with probable stock market valuation as high as $120 billion (well above its current $76 billion private market valuation). As a smaller rideshare tech firm, Lyft seeks stock market valuation of $20 billion to $25 billion (well above its current private market valuation of $15 billion).

With these astronomical stock market figures, both companies can handle their net losses below $1 billion per annum. SoftBank Vision Fund and Toyota Motor Corp are part of a consortium of capitalists that invest $1 billion in the Uber autonomous car unit. The current IPO proposal serves as a major strategic move for Uber to garner greater capital.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

2025-10-09 11:30:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-03-03 05:39:00 Friday ET

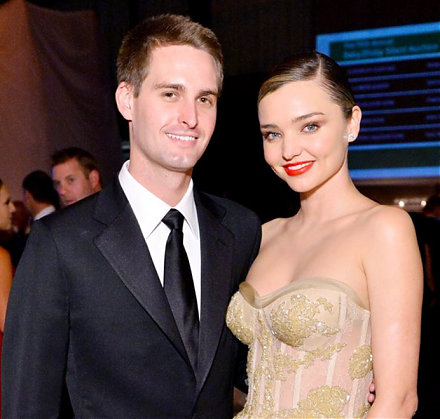

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2025-10-03 10:31:00 Friday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-07-19 18:38:00 Thursday ET

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rat