2018-01-03 08:38:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an online retail giant that he has criticized during the presidential campaign. Now U.S.P.S. runs a substantial net loss and serves as an independent agency within the federal government with minimal tax dollars for operating expenses. Package delivery has become an increasingly important part of U.S.P.S. business because the Internet has led to a sharp decline in the amount of first-class letters.

U.S.P.S. delivers 60%+ of Amazon packages with about 4 million parcels per day during the current peak year-end holiday shipping season. Amazon's other major carriers are UPS and FedEx that collectively account for about 30% of Amazon parcels. Both UPS and FedEx have long voiced their key concerns and complaints about U.S.P.S. cost structure. In fact, U.S.P.S. deficit has ballooned to about $62 billion, and this situation cannot sustain in the long run. If the Trump administration induces U.S.P.S. to charge more on Amazon packages, the ecommerce giant may pass higher costs onto key American consumers and small businesses. Worldwide delivery operations may become too expensive to the detriment of consumers. The status quo remains a time-worn impasse between ecommerce and postal service.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-05 07:33:00 Saturday ET

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GA

2018-07-11 09:39:00 Wednesday ET

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey

2025-09-28 10:10:51 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2019-10-27 17:37:00 Sunday ET

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-autho

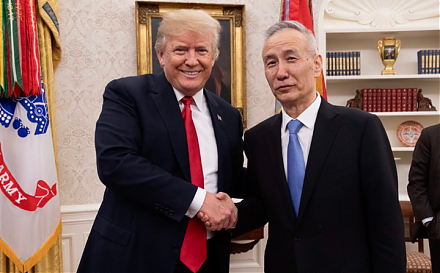

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin