2019-04-27 16:41:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Tony Robbins suggests that one has to be able to make money during sleep hours in order to reach financial freedom. Most of our jobs and life experiences train us to be consumers but not investors or owners. This memetic trend often leads to a persistent investment shortfall in America. As a recent BankRate survey suggests, only 40% of Americans are able to cover an unforeseen $1,000 expense with their deposits. Many Americans choose not to save enough for retirement.

A recent study by the Federal Reserve Bank of Saint Louis finds that only 27% of U.S. households have pension plans in place. In light of this key pervasive lack of financial discipline, Tony Robbins argues that the typical layman cannot expect to earn his or her way into a fortune. Robbins suggests that we need to make money while we sleep.

This personal finance tip sheds new light on the importance of both passive income and compound interest. For instance, if a 20-year-old adult invests $50 per week and compounds this interest income on an average 10% annual return, he or she will accumulate about $2 million at the conventional retirement age of 65. The long-term investment strategy wins throughout stock market fluctuations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2019-05-11 10:28:00 Saturday ET

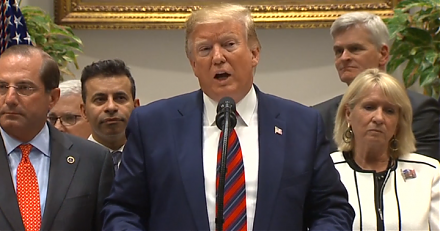

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,