2019-11-05 07:41:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Trump administration expects to reach an interim partial trade deal with China. This interim partial trade deal represents the first phase of a comprehensive trade deal between China and America. The Trump administration suspends additional tariff hikes on Chinese imports. Moreover, the Trump administration introduces a currency pact to prevent China from instituting deliberate interest rate adjustments with unfair competitive currency devaluation.

U.S. trade envoy Robert Lighthizer and Treasury Secretary Steven Mnuchin praise good progress on intellectual property protection and financial market liberalization in China. To help reduce the current trade imbalance, China plans to purchase $40 billion to $50 billion U.S. agricultural products such as soybeans and pork bellies. This interim partial trade deal suggests that it may be too early for both sides to agree on the more difficult enforcement of protective checks and balances for U.S. patents, trademarks, and copyrights.

President Trump expects to meet Chinese President Xi again at the APEC summit in November 2019. It is likely for Presidents Trump and Xi to sign the interim partial trade deal at the summit. Global stock markets surge 3%-5% from S&P 500, Dow Jones, and Nasdaq to Shanghai and Shenzhen in response to this trade deal.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-12-16 11:37:00 Monday ET

America and China cannot decouple decades of long-term collaboration in trade, finance, and technology. In recent times, some economists claim that China ma

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie

2017-03-03 05:39:00 Friday ET

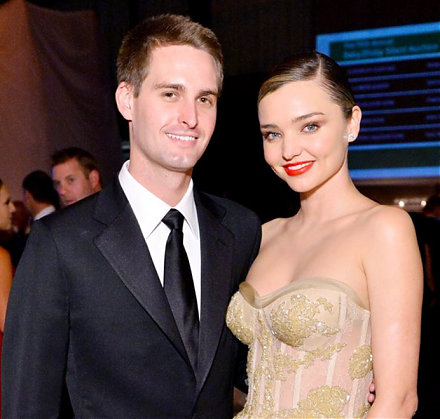

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2023-10-28 12:29:00 Saturday ET

Paul Morland suggests that demographic changes lead to modern economic growth in the current world. Paul Morland (2019) The human tide: how