2019-07-09 15:14:00 Tue ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies to raise funds as the stock exchange criteria are less stringent than other domestic boards. In recent years, the Chinese government encourages local tech firms to become more self-reliant in producing microchips and other core components. This new star board arises amid the current Sino-American trade escalation and recent U.S. embargo on the HuaWei supply chain of electronic imports.

As of mid-2019, the new star board has received applications from 122 tech firms. Tech companies with at least RMB$300 million ($43 million) net income can list on the new star board insofar as these companies maintain the minimum stock market capitalization of RMB$2 billion with RMB$100 million cash flows in the prior 3 years. The board is the first registration-driven IPO system that streamlines price flotation restrictions. Like Facebook, Google, Alibaba, and JD etc, Chinese tech companies with a dual-class shareholding structure are eligible to apply for public registration. Alibaba has to mull over its recent proposal to list on Hong Kong Stock Exchange several years after its blockbuster IPO on NYSE.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi

2017-08-01 09:40:00 Tuesday ET

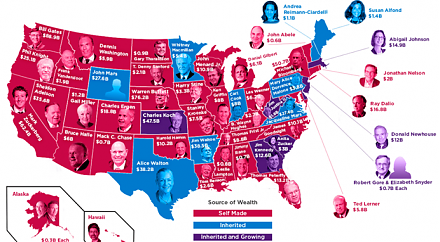

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2017-05-19 09:39:00 Friday ET

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in