2019-05-03 11:29:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Key tech unicorns blitzscale business niches for better scale economies from Uber and Lyft to Pinterest, Slack, and Zoom. LinkedIn cofounder and serial entrepreneur Reid Hoffman explains in his recent book that tech unicorns rapidly scale up core functions to reap network effects despite substantial uncertainty. Network effects often manifest in the form of freemium users (Dropbox, Facebook, and LinkedIn), cloud services (Amazon and Zoom), and online subscriptions (Apple and Netflix). About 2 decades ago, the last IPO boom brought to the stock market a boatload of profitless dotcom companies. Many of these dotcom companies never had the opportunity to blitzscale their core operations with gargantuan losses.

In accordance with the Hoffman zeitgeist of Silicon Valley, the current IPO game focuses on how tech unicorns become big before substantial economic uncertainty strikes hard. Beyond the singularity point, these tech unicorns start to worry about net profits and other socioeconomic bottomline metrics. This competitive strategy works well for tech titans such as Facebook, Amazon, Microsoft, Google, Apple, Nvidia, and Twitter (FAMGANT). Nevertheless, the same strategy may turn out to be less effective for Airbnb, Uber, Lyft, Netflix, Slack, and Zoom as they experience competitive bottlenecks in lieu of both scale economies and network effects.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-21 07:25:00 Sunday ET

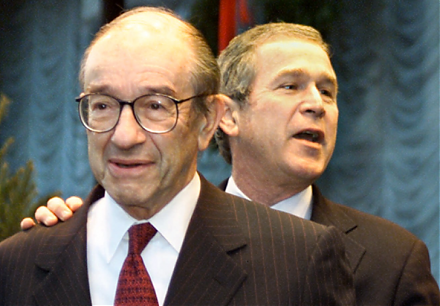

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2019-03-27 11:28:00 Wednesday ET

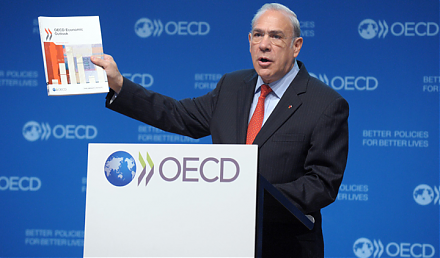

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2017-10-15 07:38:00 Sunday ET

Ivanka Trump and Treasury Secretary Steven Mnuchin both press the case for GOP tax legislation as economic relief for the middle-class without substantial t

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the