2017-12-07 08:31:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Large multinational tech firms such as Facebook, Apple, Microsoft, Google, and Amazon can benefit much from the G.O.P. tax reform. A recent stock research report assumes the effective U.S. corporate income tax rate declines from 35% to 21%-22% in January 2018 with no subsequent changes in international taxes and all other aspects of the U.S. tax legislation. Specifically, Google will receive tax benefits of more than $2 billion in 2018, Facebook expects to attain tax cost reductions of $1.5 billion, and Amazon will enjoy about $1 billion in tax credits. Also, these tech firms plan to expand their capital expenditures with preferential tax provisions in the Trump administration's current tax reform. Overall, these tech firms can expect to achieve hefty tax benefits in the range of $4.5 billion to $5 billion in the 5-year period from 2018 to 2022.

Harvard macrofinance professor Greg Mankiw entertains a key policy question: how much would the average real wage rise for each $1 decrease in the typical firm tax outlay ceteris paribus? The answer is likely to be $1.5 to $2 in real wage terms for each $1 tax cut, or equivalently $4,000 to $ 9,000 per capita per year. Several eminent economists such as Brad DeLong, Larry Summers, and John Cochrane suggest that if we take into account positive externalities and positive returns to the scale of capital usage, the resultant real wage increase can turn out to be higher. An open controversy clouds the fundamental view of whether these massive tax cuts may exacerbate fiscal inequality in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)

2025-10-10 12:31:00 Friday ET

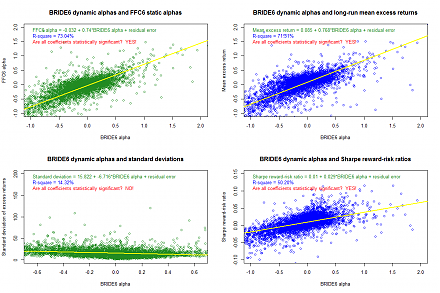

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund