2018-02-19 08:39:00 Mon ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

The root cause of this rare incidence may be Snap's recent redesign, or Jenner's newfound motherhood. The former can be a real concern that her 25 million Twitter followers share in numerous replies. These empathetic users aggravate this deep concern about Snap's recent redesign and thereby echoes ambivalent Wall Street investor sentiments.

Several Wall Street stock analysts point out that it can be more difficult for Snap to monetize the Snapchat business model in contrast to ad-income-driven Facebook, Google, and Twitter. In recent times, Snap initiates some smart strategic moves to draw a clear line between social interactions and media posts and video streams. In fact, Snap needs to manage this interim transition well as celebrity influencers such as Kylie Jenner are an essential source of high-quality content in the Snap recipe for success. With 25 million Twitter followers, Jenner carries a great deal of social influence over millennials.

In terms of demographic attributes, the typical Snapchat user is between 18 and 24 years old and tends to have much shorter attention span.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2019-03-27 11:28:00 Wednesday ET

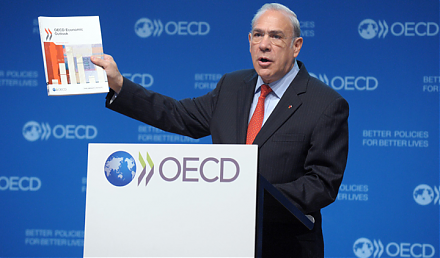

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g

2020-04-03 09:28:00 Friday ET

The Intel trinity of Robert Noyce, Gordon Moore, and Andy Grove establishes the primary semiconductor tech titan in Silicon Valley. Michael Malone (2014)

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund