2018-09-29 12:39:00 Sat ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

The Securities and Exchange Commission (S.E.C.) sues Elon Musk for his August 2018 tweet that he has secured external finance to convert Tesla into a private company. Federal regulators accuse Musk of misleading stock market investors with false public statements. This regulatory move can potentially oust Musk out of his current chief executive leadership at the electric carmaker Tesla. The S.E.C. files a recent lawsuit in the federal court in New York to accuse Musk of committing fraud by making false public statements that may inadvertently be detrimental to shareholder value.

This lawsuit seeks to bar Musk, who is both the CEO and executive chairman at Tesla, from serving as an executive director of public corporations such as Tesla. This punishment is one of the most serious remedies that the S.E.C. can impose against corporate executive incumbents. From a regulatory viewpoint, Musk might be reckless in not knowing the fact that his public statements can mislead stock market investors who maintain an active interest in Tesla shares. Both in truth and in fact, Musk has never confirmed any key deal terms such as deal price and stock exchange etc with any relevant source of external finance. Tesla shares tumble 12% in direct response to this S.E.C. lawsuit.

The S.E.C. eventually settles this lawsuit with Elon Musk who has to relinquish his chairman role but remains the CEO with complete corporate control at Tesla.

As part of this swift legal settlement, Musk and Tesla have to pay hefty fines of $20 million each. Musk and Tesla neither admit nor deny any egregious mistakes that the S.E.C. alleges in recent times.

Elon Musk ultimately has to abort his previous plan to transform Tesla into a private company. This case sets a landmark precedent for CEOs and executive chairmen who might inadvertently erode shareholder value via their erroneous tweets, public statements, articles, blogs, and posts etc.

S.E.C. regulatory scrutiny and oversight thus serve as a safety valve that prevents CEOs and executive chairmen or chairwomen from social engagement that might result in false public statements.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-01 09:40:00 Tuesday ET

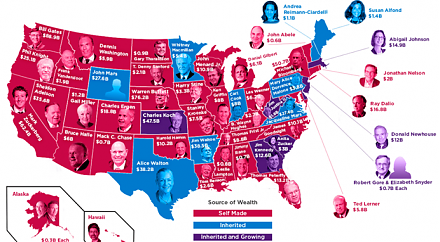

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2016-10-19 00:00:00 Wednesday ET

India's equivalent to Warren Buffett in America, Rakesh Jhunjhunwala, offers several key lessons for stock market investors: When the press o

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a