2019-09-21 09:25:00 Sat ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment for Iran, and trade peace with Europe and Japan. At the G7 summit in France, President Trump asserts that he can engage in direct talks to better resolve climate change issues and economic sanctions on the nuclear nation Iran. President Trump can meet the Iranian President Hassan Rouhani under the right circumstances. The Trump administration can further help eradicate environmental degradation on a global scale.

Also, President Trump expects Sino-U.S. trade talks to resume in September 2019. These new negotiations can help assuage the recent bilateral trade escalation with higher tariffs, verbal threats, and other aggressive countermeasures. Chinese Vice Premier Liu He indicates that China can work together to solve key trade problems through consultation and cooperation with a calm attitude. In addition, the Trump administration attains trade peace with Japan for better regional trade partnerships. Moreover, the Trump administration causes France (and other European countries such as Germany and Italy) to agree to legitimate digital tax reprieve for U.S. tech titans such as Apple, Amazon, Facebook, and Google.

Overall, peace and engagement can help resolve complex economic policy issues.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-04-25 06:35:00 Tuesday ET

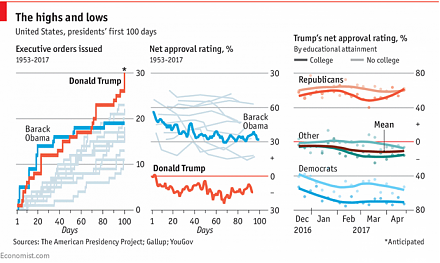

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2018-05-15 08:40:00 Tuesday ET

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

2020-01-01 13:39:00 Wednesday ET

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China s

2018-08-31 08:42:00 Friday ET

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.