2018-10-19 13:37:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations of most stock analysts and economic commentators in 2018Q3, its share price surges 9%. A peer-to-peer payment app, Venmo, enjoys 80% growth in total payment volume quarter-to-quarter. As this M&A brain child proves to be a major moneymaker for its parent company PayPal, Venmo adds 9 million peer-to-peer payment accounts to the PayPal mafia worldwide network.

PayPal now continues to expand its strategic partnership with Visa, MasterCard, American Express, Apple, Google, Samsung, and Walmart to allow cardholders to use their membership points when these consumers shop from PayPal merchants. This additional convenience empowers key consumers to integrate their electronic retail experiences with most traditional credit cards. Anecdotal evidence suggests that PayPal encompasses more than 250 million active members with about 78% of the total market share in America.

Key stock analysts and economic media commentators expect the eBay multi-year transition to the Adyen fast-payment platform to be quite bumpy in light of the long history that both buyers and sellers have almost exclusively interacted with PayPal on the prior eBay online auction platform. In hindsight, the Dutch payment platform Adyen can be a cost-effective key option for eBay, but eBay might have overlooked the tremendous positive network effects of PayPal that dominates in the electronic mobile payment market in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

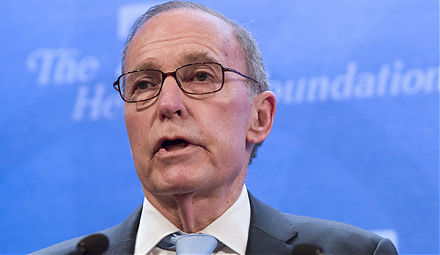

2018-08-13 12:39:00 Monday ET

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv

2018-03-07 07:34:00 Wednesday ET

President Trump tweets his key decision to oust State Secretary Rex Tillerson after several months of intense disagreement over diplomatic affairs. Trump so

2018-11-15 12:35:00 Thursday ET

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berks

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati