2019-08-26 11:30:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis of 49 Senate votes on socioeconomic and foreign-policy issues from 2001 to 2015 and national survey data from Gallup and Pew. This empirical analysis shows that the rich elite income groups seem to get what they want from their senators about 60% of the time, whereas, the poor income groups receive a low 55% fair chance. When the socioeconomic echelons oppose each other on both sides of a particular policy issue, Senate votes favor the rich with a significantly higher 63% fair chance.

In the scenario where the rich and poor voters oppose each other on a given policy issue, Democratic senators side with the rich only with a 35% fair chance, whereas, Republican senators vote in accordance with elite interests 86% of the time. Since Republicans hold majority control in Senate, U.S. congressional decisions benefit the upper echelon because legislators often follow the party line. Affluent influence that results from U.S. partisan influence can be worrisome. However, the American median voter experience is not the same as living in an oligarchy.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-23 06:38:00 Tuesday ET

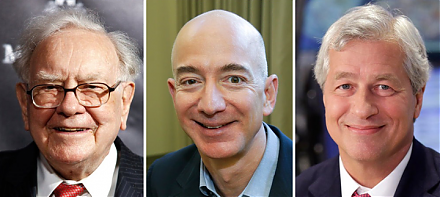

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-04-13 14:42:00 Friday ET

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dicta

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th

2019-04-03 11:35:00 Wednesday ET

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity