2019-05-19 19:31:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achieve the same economic gains that would result from more high-skill employment. The government should promote better tech advances and labor market institutions to empower workers through higher education systems. Also, the government should encourage firms to deploy better technology to boost real wage growth and labor productivity. The government can increase product market competition such that firms cannot charge monopoly prices without hiring more workers. Meanwhile, the current institutional architecture depresses U.S. private-sector wage growth (2.5% per annum from 1947 to 2000 and almost nil thereafter). In this negative light, the government should raise the U.S. tax-revenue-to-GDP ratio from 27% to the 35% OECD benchmark. The incremental fiscal intake can help ensure higher wages for tech-savvy high-skill workers.

Moreover, the government has to set clear rules with respect to tech market power, privacy, and content curation. Recent examples include the E.U. fines on Google for online search market dominance, Facebook-Cambridge-Analytica data breach, and Amazon premium user surveillance via Alexa-and-Echo artificial intelligence. These rules may entail plausible penalties on foreign interference in U.S. elections, privacy invasion, and the viral distribution of inappropriate content etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-07-01 13:35:00 Tuesday ET

In recent times, financial deglobalization and asset market fragmentation can cause profound public policy implications for trade, finance, and technology w

2020-05-05 09:31:00 Tuesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2019-10-01 11:33:00 Tuesday ET

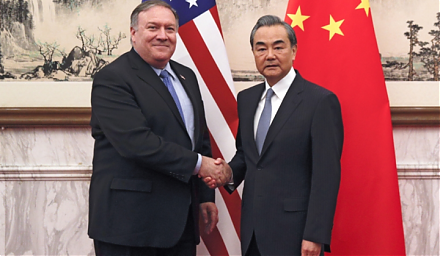

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model