2019-05-19 19:31:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achieve the same economic gains that would result from more high-skill employment. The government should promote better tech advances and labor market institutions to empower workers through higher education systems. Also, the government should encourage firms to deploy better technology to boost real wage growth and labor productivity. The government can increase product market competition such that firms cannot charge monopoly prices without hiring more workers. Meanwhile, the current institutional architecture depresses U.S. private-sector wage growth (2.5% per annum from 1947 to 2000 and almost nil thereafter). In this negative light, the government should raise the U.S. tax-revenue-to-GDP ratio from 27% to the 35% OECD benchmark. The incremental fiscal intake can help ensure higher wages for tech-savvy high-skill workers.

Moreover, the government has to set clear rules with respect to tech market power, privacy, and content curation. Recent examples include the E.U. fines on Google for online search market dominance, Facebook-Cambridge-Analytica data breach, and Amazon premium user surveillance via Alexa-and-Echo artificial intelligence. These rules may entail plausible penalties on foreign interference in U.S. elections, privacy invasion, and the viral distribution of inappropriate content etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-03-03 05:39:00 Friday ET

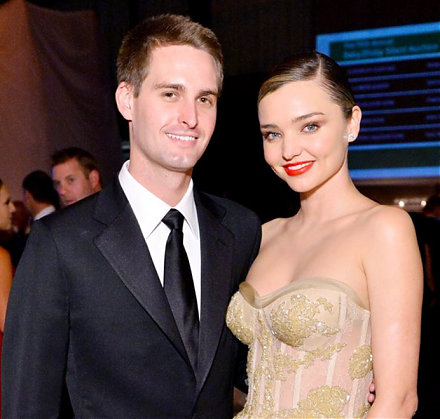

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-01-13 12:37:00 Sunday ET

We need crowdfunds to support our next responsive web design and iOS and Android app development. Upon successful campaign completion, we will provide an eb

2019-05-11 10:28:00 Saturday ET

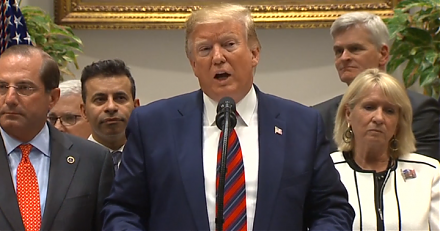

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on