2019-08-08 09:35:00 Thu ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Kobe Bryant and several other star athletes have been smart savvy investors. In collaboration with former Web.com CEO Jeff Stibel, the NBA champion invests in lean enterprises via the venture capital fund Bryant Stibel. This venture capital fund places $200 million equity stakes in a sports drink BodyArmor, an online education platform VIPKid, a new video game design firm Scopely, an online legal technology firm LegalZoom, a clean and green restaurant brand Reserve, and an enterprise sales management platform RingDNA. The Bryant Stibel venture capital return on investment in a big boon to the entrepreneurial ideology of sports star interests in technology, media, big data, and artificial intelligence etc.

Several other superstar athletes invest in their business passions with the same entrepreneurial spirit. For instance, the tennis champion Serena Williams retains an active equity interest in the meal delivery service Daily Harvest, and her sister Venus Williams invests in a financial app Ellevest that empowers women to better save for retirement. Moreover, the Golden State Warriors super star Kevin Durant invests in a delivery service company Postmates, an investment app Acorns for millennials, a drone company Skydio, and a scooter brand LimeBike. Lean startup investments can reap handsome rewards with reasonable diversification.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-23 09:22:00 Tuesday ET

Harvard economic platform researcher Dipayan Ghosh proposes some alternative solutions to breaking up tech titans such as Facebook, Google, Apple, and Amazo

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since

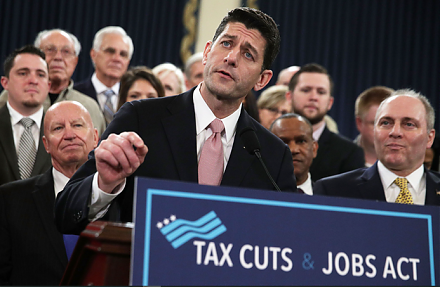

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra