2019-04-26 09:33:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnation, corruption, and often worse. If the government controls companies, people direct economic assets to further political interests as enormous favoritism, corruption, and other preferential treatment lead to inefficient market outcomes. Dimon admits that capitalist countries need stronger social safety nets because there are some fundamental flaws with capitalism. A good example is universal healthcare, and thus Dimon now collaborates with Jeff Bezos and Warren Buffett to pioneer a cost-effective employee healthcare program for Amazon, Berkshire, and JPMorgan.

Dimon further defends capitalism because private enterprise is the true engine of economic growth in any country. Although economic growth may widen the income gap between the rich and the poor, most high-income countries emerge with tech titans, big businesses, and successful innovators.

Dimon observes that U.S. bank regulators now have fewer policy instruments to avert the next financial crisis. Banks can maintain sufficient liquidity, credit supply, and procyclical capital in rare times of extreme financial stress. Dimon emphasizes the importance of long-run business profitability in contrast to short-run gains such as one-year stock price performance and share buyback.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-13 08:30:00 Thursday ET

The recent arrest of HuaWei senior executive manager may upend the trade truce between America and China. At the request of several U.S. authorities, Canadi

2019-07-03 11:35:00 Wednesday ET

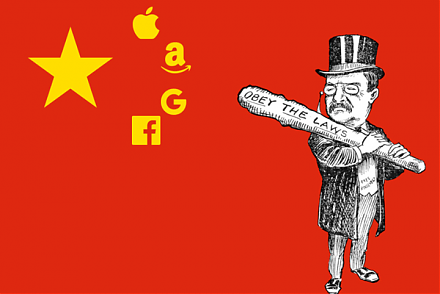

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2023-02-14 09:31:00 Tuesday ET

Eric Posner and Glen Weyl propose radical reforms to resolve key market design problems for better democracy and globalization. Eric Posner and Glen Weyl

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement