2019-04-26 09:33:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnation, corruption, and often worse. If the government controls companies, people direct economic assets to further political interests as enormous favoritism, corruption, and other preferential treatment lead to inefficient market outcomes. Dimon admits that capitalist countries need stronger social safety nets because there are some fundamental flaws with capitalism. A good example is universal healthcare, and thus Dimon now collaborates with Jeff Bezos and Warren Buffett to pioneer a cost-effective employee healthcare program for Amazon, Berkshire, and JPMorgan.

Dimon further defends capitalism because private enterprise is the true engine of economic growth in any country. Although economic growth may widen the income gap between the rich and the poor, most high-income countries emerge with tech titans, big businesses, and successful innovators.

Dimon observes that U.S. bank regulators now have fewer policy instruments to avert the next financial crisis. Banks can maintain sufficient liquidity, credit supply, and procyclical capital in rare times of extreme financial stress. Dimon emphasizes the importance of long-run business profitability in contrast to short-run gains such as one-year stock price performance and share buyback.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2018-05-07 07:32:00 Monday ET

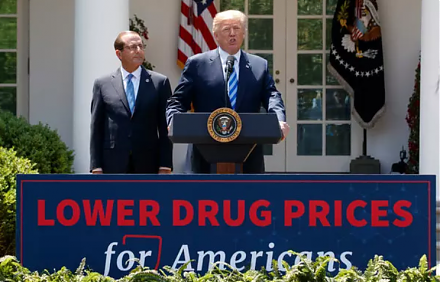

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2019-04-09 11:29:00 Tuesday ET

The U.S. Treasury yield curve inverts for the first time since the Global Financial Crisis. The key term spread between the 10-year and 3-month U.S. Treasur

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese