2018-01-01 06:30:00 Mon ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious insights into the new Basel 4 accord. This new accord balances the U.S. and French bids for minimum bank capital output floors to arrive at the key midpoint of 72.5% equity capital output under the old Basel standard approach. In fact, this harmonization helps reduce substantial heterogeneity in internal capital requirements under the prior Basel 3 regime. Although the use and introduction of internal risk models can facilitate risk-sensitive and meaningful core capital calibrations, wide capital output dispersion may be suboptimal. This wide dispersion suggests that the core capital results may differ dramatically when the bank applies different internal risk models to calibrate to the same loan portfolios. Also, some proponents point out that most recent improvements in core capital ratios result from lower private credit growth (rather than higher net equity issuance). Should banks raise equity to strengthen their core capital ratios toward the healthy range of 10%-15% or even 20%, these banks may experience high costs of capital with less available loan credit. These ripple effects can adversely affect real macro variates such as real GDP economic growth, employment, and capital equipment usage. It is thus important for global regulators to standardize minimum core equity capital requirements to assuage these concerns.

In addition to the Basel regime switch, the Federal Reserve vice chairman Randal Quarles proposes simplifying the Volcker rule that prevents banks from using their own money to place hefty market bets on stocks, bonds, indices, funds, currencies, commodities, and derivatives. In recent years, many eminent economists point out that the Volcker rule cannot be one of the culprits of the global financial crisis from 2008 to 2009. The Volcker rule may be too restrictive for most global systemically-important banks.

As part-and-parcel of this new influx of new bank rules, it is important for banks to carefully craft their living wills for better open bank resolution during a key financial crisis. Open bank resolution may involve outright liquidation, bank recapitalization, or bridge-bank sale. Overall, these new regulations can be conducive to promoting sound and efficient bank capital arrangements in most home-host jurisdictions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2019-11-03 12:30:00 Sunday ET

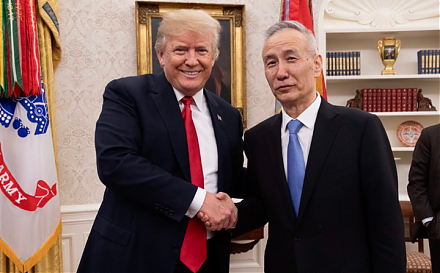

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2023-02-28 10:27:00 Tuesday ET

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-04-01 08:28:00 Monday ET

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome s

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins