2018-12-23 13:39:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As frenetic negotiations persist at Capitol Hill, the House adjourns without a final government expenditure deal. This impasse leads to a partial government shutdown, whereas, President Trump demands at least $5 billion for his presidential campaign promise of a Mexican border wall. The Trump top envoys work hard to broker a last-minute compromise with Democrats and some Republican lawmakers.

The partial government shutdown would disrupt public service operations as many federal employees face furlough and work without pay only a few days before the festive Christmas holiday season. While many market watchers expect the partial government shutdown to be temporary, this shutdown echoes the previous Trump verbal threat that he would be proud to shut down the government for better border security.

Stock market investors respond to this shutdown with negative consequences. Key stock market indices from S&P 500 and NASDAQ to Dow Jones reach historical low levels with near-term 5%+ losses in the prior decade. Several economic media commentators expect the next stock market rally to emerge in light of better stock market investor optimism early-2019.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2018-05-06 07:30:00 Sunday ET

President Trump withdraws America from the Iran nuclear agreement and revives economic sanctions on Iran for better negotiations as western allies Britain,

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2018-05-09 08:31:00 Wednesday ET

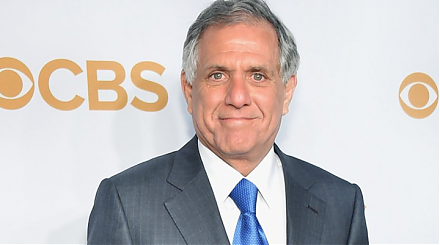

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached