2018-09-30 14:34:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal conspiracy that they have kept stock loans in the stone age to stifle competition in the $2 trillion stock-lending market. These large banks boycott the startup platforms AQS, Data Explorers, and SL-x in order to maintain their competitive advantage in stock loans. In this way, these banks maintain monopoly control over stock loans and so charge excessive fees to investors and short-sellers.

A counter argument sheds skeptical light on the court decision that continuing to execute stock loans under the current rules and standards somehow amounts to an illegal conspiracy. This alternative argument suggests that these class actions against the banks would result in an unreasonable restraint on trade. This dispute boils down to whether there is sufficient evidence of collusion among the plaintiffs in direct competition with the fresh startup platforms.

Stock loans are quite important to short-sellers when the investor borrows stocks to immediately sell them at a premium. Institutional investors with substantial stock positions can profit from lending out these stocks, whereas, borrowers aim to profit by buying the stocks at lower prices later.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-11 08:42:00 Monday ET

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to t

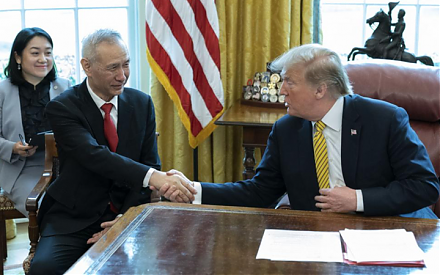

2018-03-25 08:39:00 Sunday ET

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2018-07-25 11:41:00 Wednesday ET

President Trump hails and touts America's new high real GDP economic growth in 2018Q2. The U.S. is now a $20+ trillion economy, and America hits this mi

2018-01-08 10:37:00 Monday ET

Spotify considers directly selling its shares to the retail public with no underwriter involvement. The music-streaming company plans a direct list on NYSE

2019-11-03 12:30:00 Sunday ET

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice