2018-03-13 07:34:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

From crony capitalism to state capitalism, what economic policy lessons can we learn from President Putin's current reign in Russia? In the 15 years of President Vladimir Putin's rule, Russia has increased its state control over economic growth that exceeds the average economic growth rate in the immediate post-communist era. With 1.5% meager economic growth, 15% inflation, and 6% unemployment, the Russian government concentrates both political and economic power in Putin's hands. This power concentration leads to a highly assertive foreign policy.

Putin uses energy as a diplomatic instrument, and abundant revenue streams from extractive oil industries obfuscate the core need for structural economic reforms in Russia. In recent years, U.S.-driven western countries impose economic sanctions on Russia and have brought about economic stagnation there. Hence, the Russian economy continues to struggle with few visible traces of new economic growth. As Europe struggles with its own economic projections due to its own economic model deficiencies, Russia shows no signs of diverting from core state capitalism without substantive evidence of a more sustainable economic model. In reality, only better political competition can induce the Putin administration to change course.

However, the current communist political landscape cannot allow for this political competition to flourish in practice.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-07-07 10:33:00 Friday ET

Warren Buffett invests in American stocks across numerous industries such as energy, air transport, finance, technology, retail provision, and so forth.

2019-09-07 17:37:00 Saturday ET

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rat

2018-03-02 12:34:00 Friday ET

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariff

2019-02-07 07:25:00 Thursday ET

President Trump picks David Malpass to run the World Bank to curb international multilateralism. The Trump administration seems to prefer bilateral negotiat

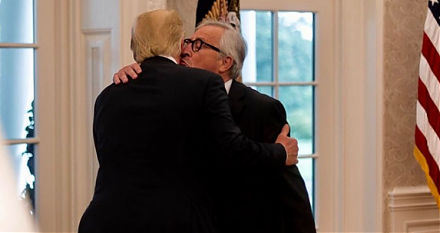

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2025-10-04 13:37:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund