2018-11-01 08:36:00 Thu ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance test of driverless vehicles in China. Ford provides autonomous vehicles that fits the Baidu proprietary autonomous navigation system Apollo. On-road car tests begin to take place in 2018Q4.

Ford and Baidu both aim to achieve the U.S. SAE Level 4 standard. The U.S. SAE industry classification measures the level of *human involvement* in autonomous vehicles, and the SAE Level 4 standard stipulates that driverless vehicles can run autonomously within specific areas under the correct weather conditions. By this standard, the Ford-Baidu autonomous vehicles require no human intervention at all. Although Ford and Baidu have yet to disclose the financial terms and ownership structure details of this Sino-U.S. joint venture, the tech firms leverage innovative artificial-intelligence and wireless connectivity solutions that improve the safe and convenient passenger experiences in different environments.

Most user acceptance tests are likely to take place in China, and the ultimate Level 4 driverless vehicles will run on both Chinese and American soil. Through this core strategic partnership with Baidu, Ford can secure its competitive advantage and moat in autonomous cars in response to intense competition from Uber, Lyft, Tesla, and Waymo etc. Autonomous vehicles remain a top long-term strategic priority for several world-class carmakers from Audi and BMW to Mercedes-Benz and Toyota.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2018-06-21 10:42:00 Thursday ET

Harley Davidson plans to move its major production for European customers out of America due to European Union tariff retaliation. European Union retaliator

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2021-07-07 05:22:00 Wednesday ET

What are the best online stock market investment tools? Stock trading has seen an explosion since the start of the pandemic. As people lost their jobs an

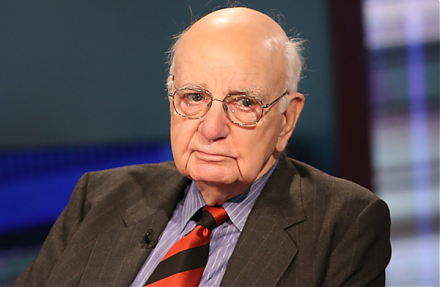

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2017-12-01 06:30:00 Friday ET

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M