2019-04-19 12:35:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community banks and regional financial institutions with less systemic risk exposure, whereas, the most stringent requirements remain for big banks that pose the greatest risks to the U.S. financial system. The most stringent requirements include the Dodd-Frank macroprudential stress tests that focus on the main vulnerable parts of the financial system such as residential mortgages, auto loans, and corporate credit lines. The new rules would significantly reduce regulatory barriers for small community banks and regional financial institutions. Specifically, the smaller deposit-takers operate within the reasonable range of $100 billion-$250 billion in total assets. U.S. banks that operate with $250+ billion total assets (or $75 billion cross-jurisdictional capital flows) would continue to meet the same prudential standards such as high liquidity coverage and sufficient core equity capital adequacy etc.

The U.S. globally systemically important banks (GSIBs) would continue to conduct the Federal Reserve macro stress tests each year, but these GSIBs would report the test results only once every 2 years. These recent institutional arrangements help ensure a balance between macro-financial stabilization and micro-prudential deregulation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-14 08:24:00 Tuesday ET

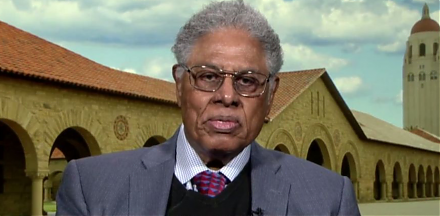

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2018-05-09 08:31:00 Wednesday ET

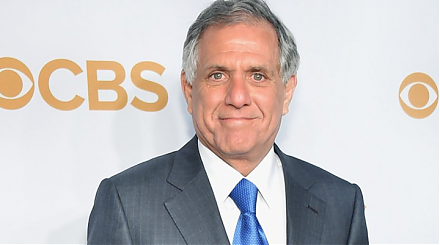

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs