2018-06-14 10:35:00 Thu ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cycle. All of the 35 U.S. large banks such as JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo pass the annual stress test and thus would be able to lend even under the grimmest economic conditions. During the Trump administration, the U.S. Treasury and Federal Reserve may roll back at least some of the Dodd-Frank rules and regulations.

These extreme economic conditions include 10% unemployment, a sharp decline in general house prices, and a severe recession in Europe and elsewhere. Even under these dire conditions, the big banks hold sufficient capital buffers that would exceed the financial-sector equity claims back in the years just before the Global Financial Crisis. The Federal Reserve retains the final veto power to restrict any dividend hikes or share repurchases that the banks may pursue in order to return cash distributions to their shareholders.

It is important for financial intermediaries to substantially increase their core equity capital buffers in order to safeguard against extreme losses that might arise in rare times of financial stress such as the Global Financial Crisis from 2008 to 2009.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2019-06-01 10:33:00 Saturday ET

Top tech firms such as Google, Intel, and Qualcomm suspend Android services to HuaWei as the Trump administration blacklists the Chinese company. HuaWei can

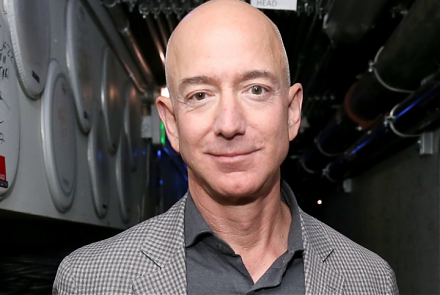

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an