2017-09-19 05:34:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential election in 2016. Facebook admits that the Russian Internet Research Agency's prior abuse of their social network platforms affects 126 million users in America. Google confirms that the Kremlin Internet Research Agency spreads more than 1,000 inflammatory videos on YouTube to sway the U.S. presidential election. Twitter further flags more than 131,000 inflammatory messages on its platform.

Stock market observers marvel at the extent to which these high-tech platforms spread viral content via social media. Both Democrats and some Republicans complain that these companies have waited nearly a year to publicly admit the scary scope of American exposure to the Russian effort to spread political propaganda during the 2016 presidential election campaign.

Senators push for harsh remedies such as new regulations on social media marketing practices in the form of rules for political advertisement on television. This development suggests a near-term stock market pushback for Facebook, Google, and Twitter.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

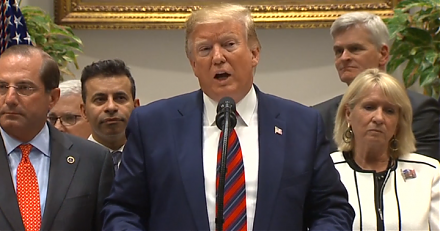

2020-01-01 13:39:00 Wednesday ET

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China s

2019-03-13 12:35:00 Wednesday ET

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete o

2019-11-07 14:36:00 Thursday ET

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Org

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance